If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

Nyserda solar tax credit.

In addition to our incentive programs and financing options your business may qualify for federal tax credits for getting solar.

A similar tax credit is available at the state level for systems up to 25 kilowatts in capacity.

It applies to you even if you went solar with a lease or.

Below is an overview of the incentives available for installing a solar electric system on a commercial building in ny.

Learn how you can benefit from new york s solar incentives rebates tax credits today.

If you re a new york state business owner interested in filing for a tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

First you don t have to purchase your system to claim the credit i e.

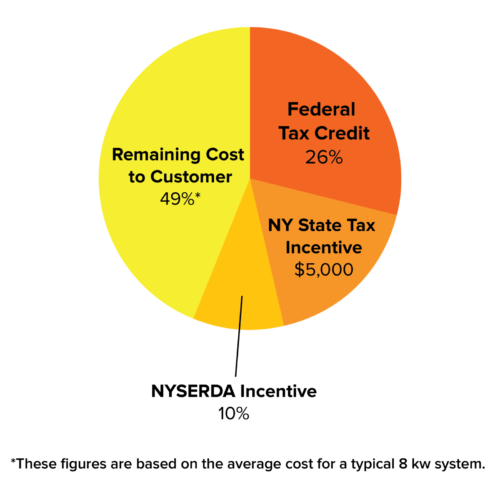

In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home.

New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less.

You are eligible to receive a federal tax credit worth.

New york is a top 10 solar state 1 and for good reason.

For instance if your system costs 15 000 you d be able to take a 3 750 tax credit on your state taxes.

As a part of its ambitious reforming the energy vision initiative 2 new york is making solar accessible to households across the empire state.

The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

The great advantages of the solar equipment tax credit are twofold.